Create your own Yield Stack.

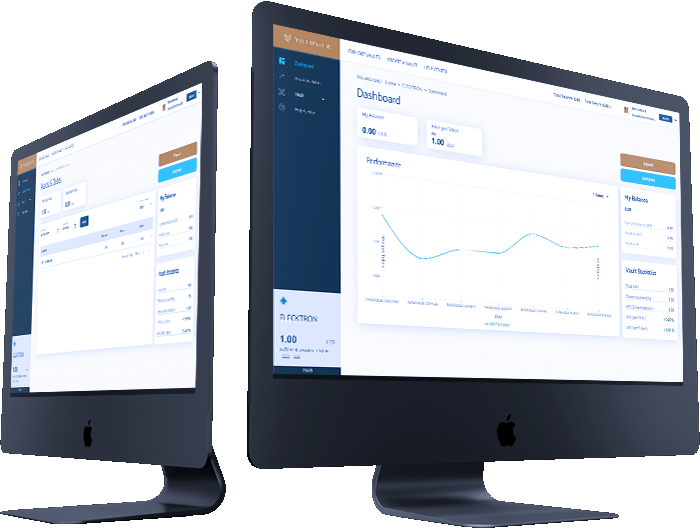

Yieldster Automation Platform

We are replacing the technology barriers with an intuitive and easy to use UI to make Yield Stacking as easy as doing online banking.

Create your own Yield Stack

A Yieldster vault allows investors to automatically execute attractive investment strategies. Different strategy templates can be combined easily to construct high performing and complex portfolio management strategies. Our platform does the heavy lift for you under the hood.

Easy to use UI

In the past it was not possible doing Yield Stacking without a deep technical know how or a blockchain developer on your side. This has changed with the Yieldster DeFi Automation Platform. We are replacing the technology barriers with an intuitive and easy to use UI to make Yield Stacking as easy as doing online banking.

Automatically reacts on market conditions

Our algorythm auotmatically reacts on market conditions, so you don't have to stick on your computer to check your investment all the time. And our inbuilt Order Balancer & Executioner finds always the best paths for your orders so your transaction costs are reduced dramatically.

Why should I use the

DeFi Automation Platform?

It drastically Reduces the Barrier of Entry for Users & Investors.

Real Yield? Yes, of course!

Our platform is the perfect tool to earn real yield. You can easily create vaults and apply your own strategies to realize real yield.

How does it work?

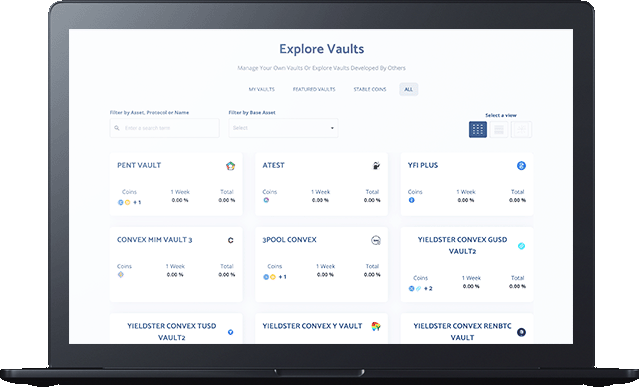

Invest in a public vault or create your own vault - it's your choice!

Invest in a public vault

With the Yieldster Automation Platform it's easy to find a vault that fits your needs and risk portfolio.

- Explore public vaults and find the one that fits

- Check strategies and conditions of the vault

- Start investing by the push of a button (maybe two)

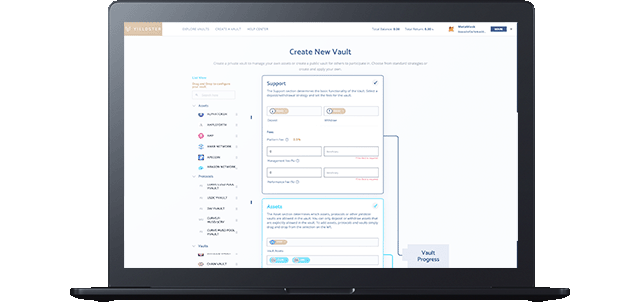

Or Create your own vault

With your own vault you enroll the full power of the Automation Platform. You are in full control of your investment. Select assets, protocols and the strategy of your choice how you want to invest. Different strategy templates can be combined easily to construct high performing and complex portfolio management strategies. And even Yield Stacking is made easy with our drag & drop interface.

Create your vault

Apply strategies

Deposit funds

Start earning

Now go to yieldster.finance and start Yield Stacking:

yieldster.financeCase Study

seriesOne LIVA Fund

The seriesOne LIVA Fund is the first fully licensed fund built upon the Yieldster Framework. Investors directly own their equity in the seriesOne LIVA Fund, while maintaining full exposure to the underlying DeFi investments.

The seriesOne LIVA Fund is powered by an autonomous, proprietary artificial intelligence (AI) algorithmic strategy that deploys capital across yield bearing DeFi protocols to provide liquid and stable investment returns over time.

The seriesOne LIVA fund is a restricted public Yieldster vault, accessible to anyone whitelisted by the Fund Maneger. It promotes its strategies to ends users within the Yieldster ecosystem as well as directly to institutional investors.

Yieldster Vaults

Yieldster Vault targets two groups of users - the professional strategy developers and investors.

Investors

- A Yieldster Vault allows investors to apply and execute attractive investment strategies in the most secure and cost efficient way

- To enable sophisticated leveraged strategies, the Yieldster Vault can manage both assets and loans

- Investors can move their assets in and out of DeFi protocols and farms at dramatically reduced costs and sometimes no costs at all

- Investors can hold any asset or loans approved within the Yieldster Framework in a highly secure environment based on a forked version of the audited gnosis safe

- Investors can view all aspects of their underlying assets and loans guaranteeing unprecedented transparency

- Accurate, reliable and auditable pricing of all underlying assets used in Yieldster Vault strategies

Strategy Developers

- The Yieldster Vault enables strategy developers to focus on developing their strategies rather than handling and managing assets. Different strategy templates can be combined easily to construct high performing and complex portfolio management strategies

- Approved strategy developers can create public Yieldster Vaults to share and promote their strategies to end users, and promote their Vaults across the Yieldster environment

- Reduced time and costs of smart contract audits for developing new strategies

- To ensure regulatory compliance, Strategy Developers can target or exclude specific users or groups through easy access management of the Vault

- Vault tokens are automatically available as assets or collateral within other Yieldster Vaults and instantly qualify for leverage of up to 2.5 times

- Qualifying projects may also receive additional seed liquidity through the seriesOne Liva Fund or other special purpose funds